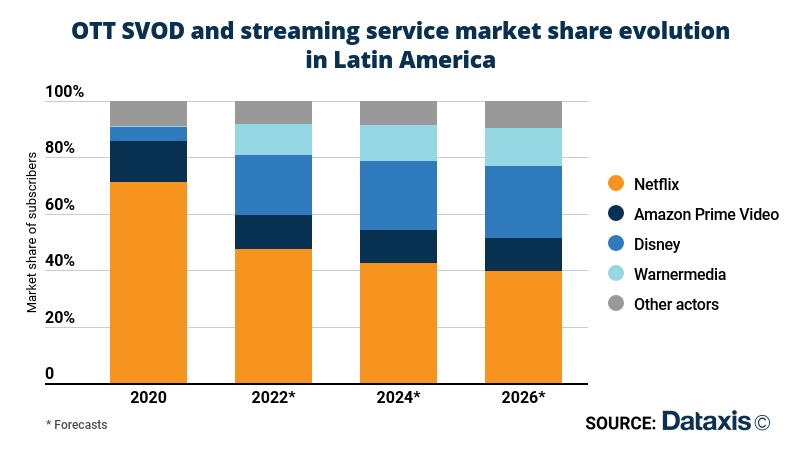

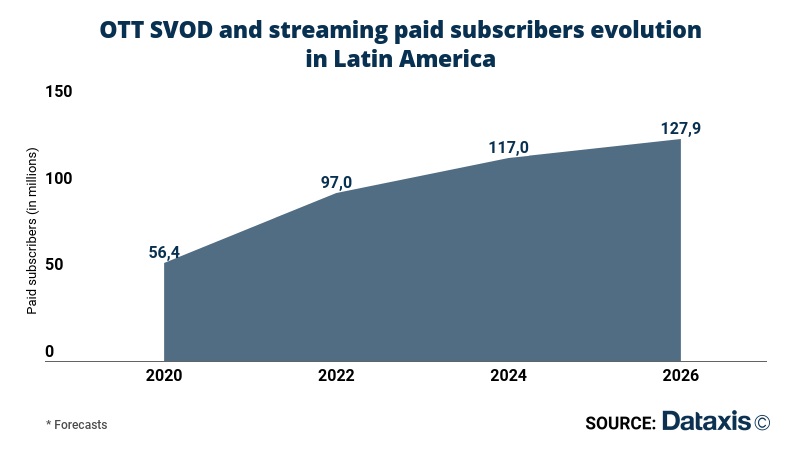

The consultancy firm predicts the number of SVOD accounts will grow from 83 million in 2021 to almost 130 million in the next five years, with Netflix remaining leader, and over 80% of the market divided between Netflix, Disney, Warner Media and Amazon Prime.

In 2021, the dynamics of the SVOD OTT market in Latin America were altered by the entrance of some of the world’s largest content producers, namely Disney (with Disney+ and Star+) and Warner Media (with HBO Max).

A new report from Dataxis shows that as a result of this increased competition, the subscription growth reached an all-time record, with a 47.2% increase over the previous year, for a total of 83 million paid accounts at the end of 2021.

On the downside however, there was a decline in monthly ARPU (average revenue per user) (-7.4% to US$ 5.90), partly due to discounts offered by platforms to capture additional market share. Additionally, it is to be noted that despite the slow growth shown by Netflix, the service remains the market leader in this segment.

Dataxis believes that there will be nearly 128 million SVOD OTT accounts in Latin America by 2026.

It is estimated that a structure with four strong competitors will likely be maintained with Netflix, Disney, Warner Media and Prime Video. By 2026, these 4 platforms will hold approximately 83% of total accounts.

In 2021, pay TV operators have become major players in the expansion of OTTs. Distribution agreements proliferated as pay TV companies stepped up their transition to a multi-aggregation strategy. Their objective is to become a distinguishable gateway in a world of heavily fragmented content offerings. So far, the coexistence of direct pay TV and OTT services has been based on the provision of distinct services.

This apparent harmony was disrupted by the arrival of Star+, which broke the boundaries prevailing between on- demand and linear content. The platform was indeed launched with a catalogue containing both premium programming and content from Disney’s linear signals.

In terms of affordability, the competition launched a war of promotional offers and bonuses. Although Netflix’s ARPU is currently the highest among OTT services in Latin America, it still remains below the platform’s global levels. Moreover, the market leader’s low pricing is hampering the rest of its competitors.

In 2021, SVOD OTT ‘s business revenue was nearly US$5 billion, and is projected to reach around US$9 billion by 2026, with a stable ARPU at around US$6 in the period.