ViX surpasses 10 million global subscribers; company secures new partnership with Disney Entertainment and refinances $1.5B in debt.

TelevisaUnivision reported its second-quarter 2025 financial results, highlighting a solid performance driven by the growth of ViX, its streaming platform, which reached 10 million international subscribers, as well as the success of its sports broadcasts.

The company reported 10% growth in adjusted OIBDA, which reached US$398 million, driven by disciplined execution and the continued expansion of its direct-to-consumer business.

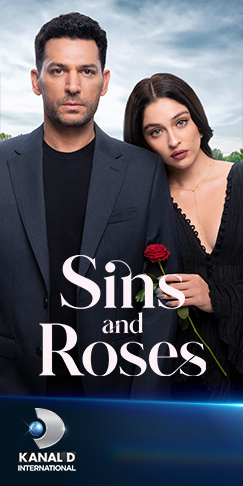

ViX, surpassed 10 million global subscribers and delivered double-digit year-over-year growth, supported by a robust content strategy that blends premium scripted programming, live sports, and multiplatform offerings.

Major international sporting events, including the CONCACAF Gold Cup and the FIFA Club World Cup, drove record-breaking viewership and advertising demand across TelevisaUnivision’s networks and ViX in both the US and Mexico, further solidifying its position as a top sports content provider for Spanish-speaking audiences.

During the quarter, the company also formed a multi-region distribution partnership with Disney Entertainment, which will bring its leading US networks into the Hulu + Live TV core channel lineup and provide ViX subscribers in Mexico with bundled access to Disney+.

Total consolidated revenue for the quarter was $1.2 billion, down from $1.3 billion in Q2 2024, reflecting a 400-basis-point foreign exchange headwind. In the US, revenue rose 2% to $816 million, while revenue in Mexico declined 14% to $394 million, or 4% excluding FX.

Advertising revenue decreased 5% to $742 million, or 1% excluding FX. In the U.S., ad revenue declined 2% to $455 million, representing a sequential improvement over Q1, driven by stabilization in linear ratings and continued growth in ViX. In Mexico, ad revenue remained steady in local currency, with gains from ViX and strong sports programming offsetting softer local ad sales.

Subscription and licensing revenue held flat at $443 million, up 2% excluding FX. Growth was driven by ViX’s premium tiers in both markets, which helped offset declines on linear platforms due to a key distribution renewal cycle in Mexico. In the U.S., subscription revenue grew 9% to $348 million. In Mexico, it declined 23% to $95 million, but increased 13% when adjusted for foreign exchange and the distribution cycle.

Cash flow from operations was $272 million, compared to $88 million in Q2 2024. Capital expenditures totaled $23 million, consistent with the amount reported in the prior year. The company ended the quarter with $585 million in cash.

On July 15, 2025, TelevisaUnivision completed the refinancing of $1.5 billion in 2027 Senior Secured Notes, issuing new notes due in 2032. The company is also actively engaged in discussions regarding refinancing of its Term Loan A and Revolving Credit Facility, both of which mature in 2027.

“This quarter reflects meaningful progress across our business, driven by a reimagined content strategy that’s beginning to show strategic payoff,” said Daniel Alegre, CEO of TelevisaUnivision. “We’re seeing stronger performance and deeper audience engagement. ViX continues to scale, and we’re energized by the momentum heading into the second half of 2025.”