In the following report, Fabric Data analyzes the growing popularity of Asian titles in the country and how platforms are adapting their content strategies to U.S. audience preferences.

In recent years, Asian content has grown significantly, both in number and popularity. What was once considered niche content is now a significant part of the global mainstream, especially among younger audiences.

A new report by Analytics company Fabric Data studies this growing trend to see which genres and productions are gaining the most ground in the territory.

Asian Productions Gain Visibility in the U.S.A.

South Korea and Japan lead this shift. While Hollywood slows down due to rising production costs, these countries are producing more and faster, finding success across borders. The global turning point came when Parasite (2019) won the Oscar and Squid Game (2021) became a phenomenon. Since then, Asian productions have maintained a steady presence in global rankings. Series like The Glory (2022), Extraordinary Attorney Woo (2022), My Roommate Is a Gumiho (2021), and Light Shop (2024) have gained strong international traction on streaming platforms, such as Netflix, Prime Video and Disney+.

Japanese cinema has experienced a remarkable surge in recent years, with titles achieving widespread global recognition. Films like Your Name (2016) marked a pivotal moment in Japanese cinema, standing out as one of the most significant productions in its genre. This success paved the way for other anime films to gain greater visibility in mainstream cinema. In this context, Demon Slayer: Mugen Train (2020) became one of the most notable titles, reaching unprecedented popularity and surpassing other major Japanese productions such as Oscar-winning Spirited Away (2001).

This growth suggests evolving audience tastes and the arrival of new content hubs that may increasingly share the stage with Hollywood.

Japanese and Korean Titles Expand on U.S. Platforms

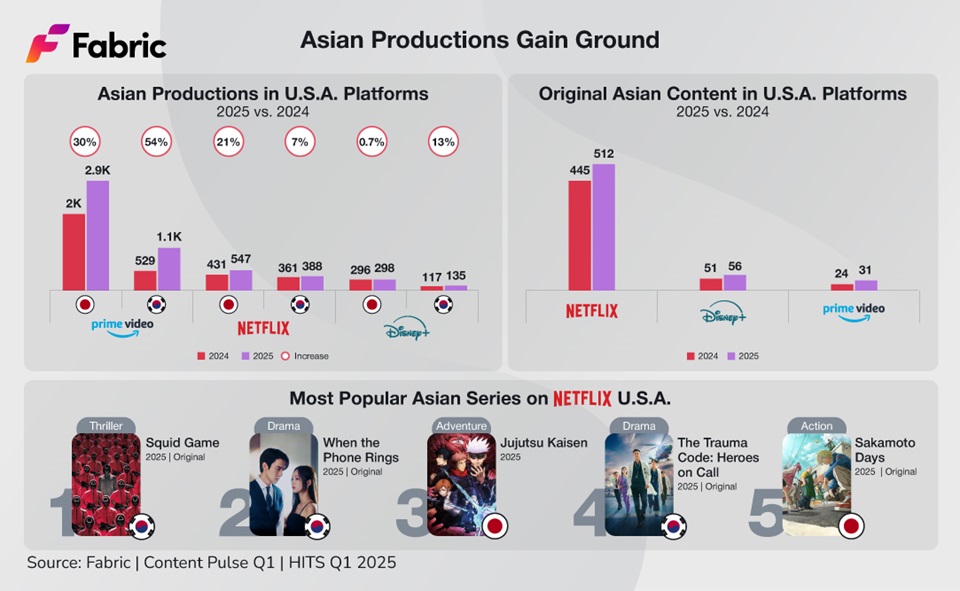

Between 2024 and 2025, Japanese and Korean titles increased across all major U.S. platforms:

Prime Video led growth, expanding both Korean and Japanese libraries. Japanese titles grew by 30%, while South Korean titles saw a 54% increase.

Netflix increased mostly in Japanese content, with a 21% growth in Japanese titles, compared to a modest 7% increase in South Korean content.

Disney+ showed modest growth, with a 0.7% increase in Japanese titles and a 13% increase in South Korean titles.

These trends reflect rising demand and show how platforms are adapting their content strategies to U.S. audience preferences.

Series vs. Movies: What U.S. Viewers Prefer

In 2025, series make up 64% of the Japanese and Korean content available in U.S. catalogs, while movies account for the remaining 36%. This aligns with global trends favoring serialized storytelling and long-term engagement. From 2024 to 2025, Netflix, Prime Video, and Disney+ increased their availability of series more than movies.

In fact, the percentage of U.S. households watching movies dropped 14% in the last year (from 77% in 2023 to 66% in 2024). Series viewership remained stable, reinforcing why platforms are prioritizing series over movies in their content strategies.

Who’s Investing Most in Original Asian Content?

Netflix is the leading investor in original Asian content. By 2025, it had produced over 510 original titles in South Korea and Japan. This surpasses other platforms significantly.

Its 2025 lineup includes 25 new Korean titles—11 series, 7 movies, and 7 variety shows—produced entirely in South Korea.

Most Popular Asian Series on Netflix U.S.

In 2025, 4 of the top 5 most-popular Asian series on Netflix U.S. were Netflix Originals. In addition, 3 of those were produced in South Korea:

Squid Game (2021)

When the Phone Rings (2024)

The Trauma Code: Heroes on Call (2025)

Squid Game became a global phenomenon upon its release in 2021, captivating audiences with its gripping storyline and unique take on survival games. As one of Netflix’s most successful originals, it brought Korean content into the international spotlight, particularly in the United States. Given its massive success, it’s no surprise that Netflix invested in a third season, which premiered on June 27th. The season was a hit, maintaining its position as the most popular series in the United States for the three weeks following its release.

The top 5 is completed by two Japanese anime titles, Jujutsu Kaisen (2020) and Sakamoto Days (2025), the last one being one of Netflix’s own original productions. Another title with high popularity on Netflix U.S. is the K-drama When the Stars Gossip (2025), which is also an original production from the platform.

Leading Genres in Asian Streaming Content

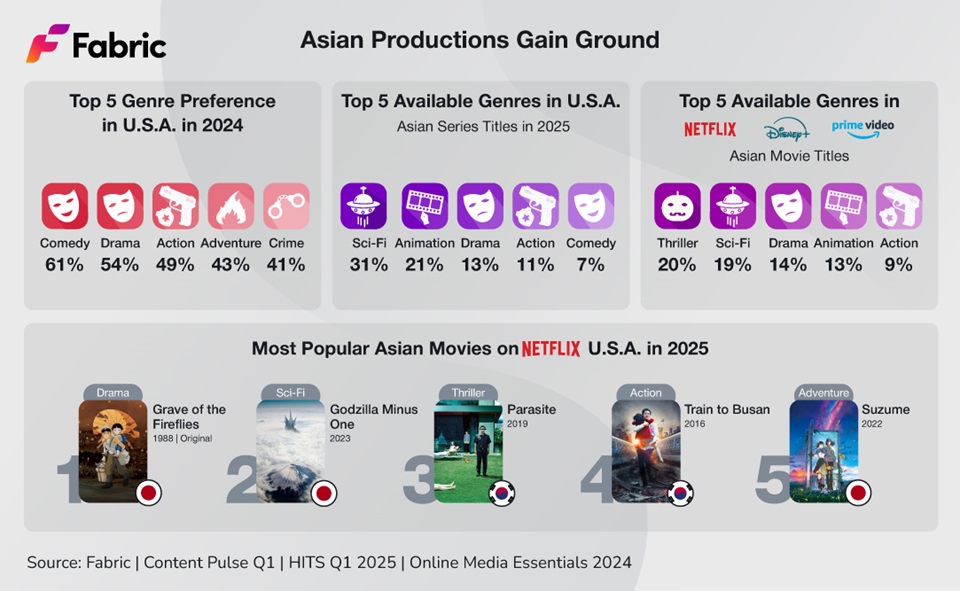

When looking at the genres of Asian series available on major U.S. streaming platforms, sci-fi leads the way, representing 31% of all titles. It is followed by:

Animation (21%)

Drama (13%)

Action (11%)

Comedy (8%)

This differs from overall U.S. genre preferences in 2024, where comedy and drama ranked higher (62% and 55%, respectably) and sci-fi ranked lower at 35%. Netflix’s focus on sci-fi and animation suggests it’s anticipating future shifts in audience interest.