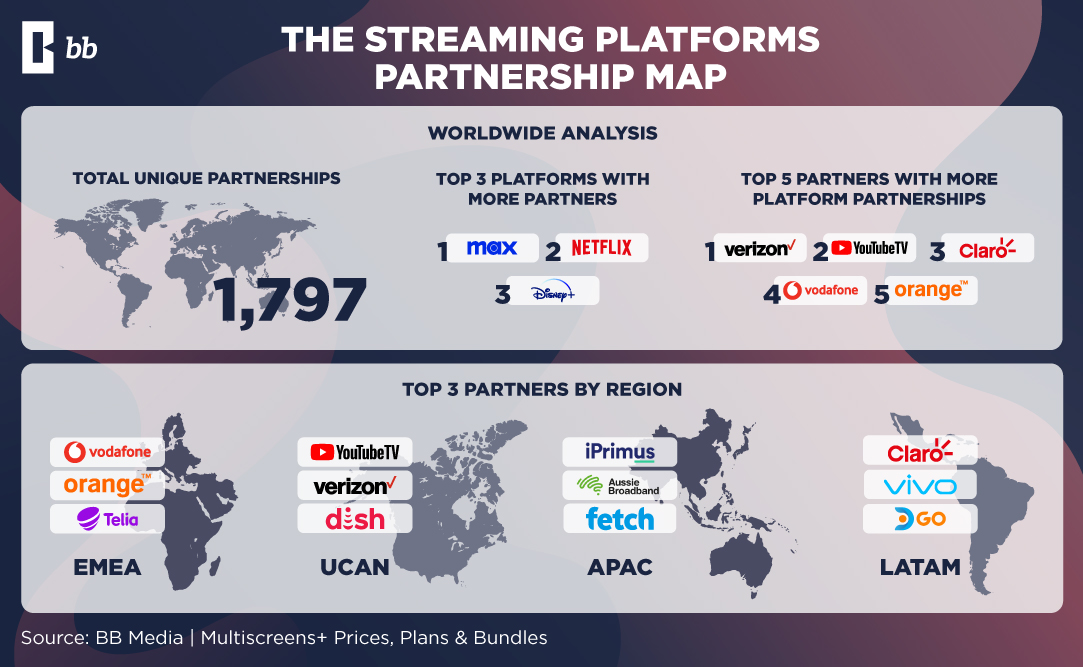

In the following report, BB Media takes a look at the main alliances between telecommunication companies and how they impact the growth of their streaming services in the different regions.

In a competitive market, where strategic alliances are essential for the growth of streaming platforms, 1 in 3 of services have already established key partnerships, with 77.9% of these alliances formed with telecom and Pay TV providers. This underscores the vital role local telecom and Pay TV providers play in helping streaming platforms gain new subscribers.

BB Media’s global analysis of streaming platform partnerships highlights the prevalence of commercial bundles (63.7%), which allow users to access multiple streaming services through integrated packages. These collaborations benefit companies by combining services to create a comprehensive user experience while offering advantages such as promotional pricing or free trial periods. Additionally, these alliances provide greater convenience by managing multiple services in a single transaction.

Regional Insights: Key Partners in EMEA, APAC, LATAM, and UCAN

BB Media breaks down this data by region, tracking partnerships daily across 148 countries. In the EMEA region, Vodafone leads with 17 partnerships, followed by Orange with 15, and SFR and Telia, each with 10 alliances. Notably, they all have Netflix, MAX, Disney+, and Prime Video as partners. The only exception is Telia, which is not yet allied with Disney+.

In APAC, Iprimus and Aussie Broadband lead with 9 partnerships each, while Ais, Fetch, and Telkomsel follow with 8. Netflix and Prime Video are the top partners across this region.

In LATAM, Claro dominates the scenario with alliances with 17 platforms, followed by VIVO with 12, and DGO with 11. DGO is allied with Paramount+, MAX, and Disney+, but still has an opportunity to partner up with Prime Video.

In UCAN, Dish, Verizon, and YouTube TV top the list with 20 partnerships each, the highest globally. Xfinity follows with 15, and Cox Communication with 13. All these partners are allied with MAX, Netflix, STARZ, and Paramount+, except Dish, which has not yet secured a Paramount+ alliance.

Most of these telecom alliances offer bundled packages that include full access to one or more streaming services, often with discounts or free trial periods, combined with internet, mobile, or TV plans.

Opportunities for Financial Services and Ecommerce Collaborations

Despite the significance of telecom partnerships, alliances with financial services remain a great opportunity for the industry. BB Media’s analysis reveals that 4.3% of streaming alliances are with financial services, with LATAM and APAC leading these agreements. Other regions, such as EMEA and UCAN, could benefit from this strategy.

Ecommerce partnerships, particularly with Mercado Libre in LATAM, have gained relevance, offering users discounts on subscriptions to Disney+, Max, Paramount+, and Vix, as well as benefits like free shipping. As both industries continue to grow, these collaborations represent strategic opportunities to reach shared target audiences.