Backed by its Marvel and Star Wars originals on Disney+, and the bundle with Hulu and ESPN+, Disney continues to grow in terms of demand in the global market. In this context, Parrot Analytics views Disney as one of the three media conglomerates -along with Netflix and Warner Bros. Discovery- with the best long term outlook.

As Disney reports earnings in the midst of a bear market, Wall Street souring on streaming, and significant political headwinds directly impacting Disney World in Florida, Parrot Analytics has found signs of long term strength in the company’s streaming and entertainment efforts.

Disney’s path to streaming dominance lies in its bundle: Disney+ and Hulu are already leaders in streaming original and exclusive licensed content demand, and ESPN+ will become more integral in the near future as current sports broadcasting deals expire and major North American leagues sell more exclusive games to streaming platforms.

When it comes to global and US demand for content, Disney sets the industry pace in several categories:

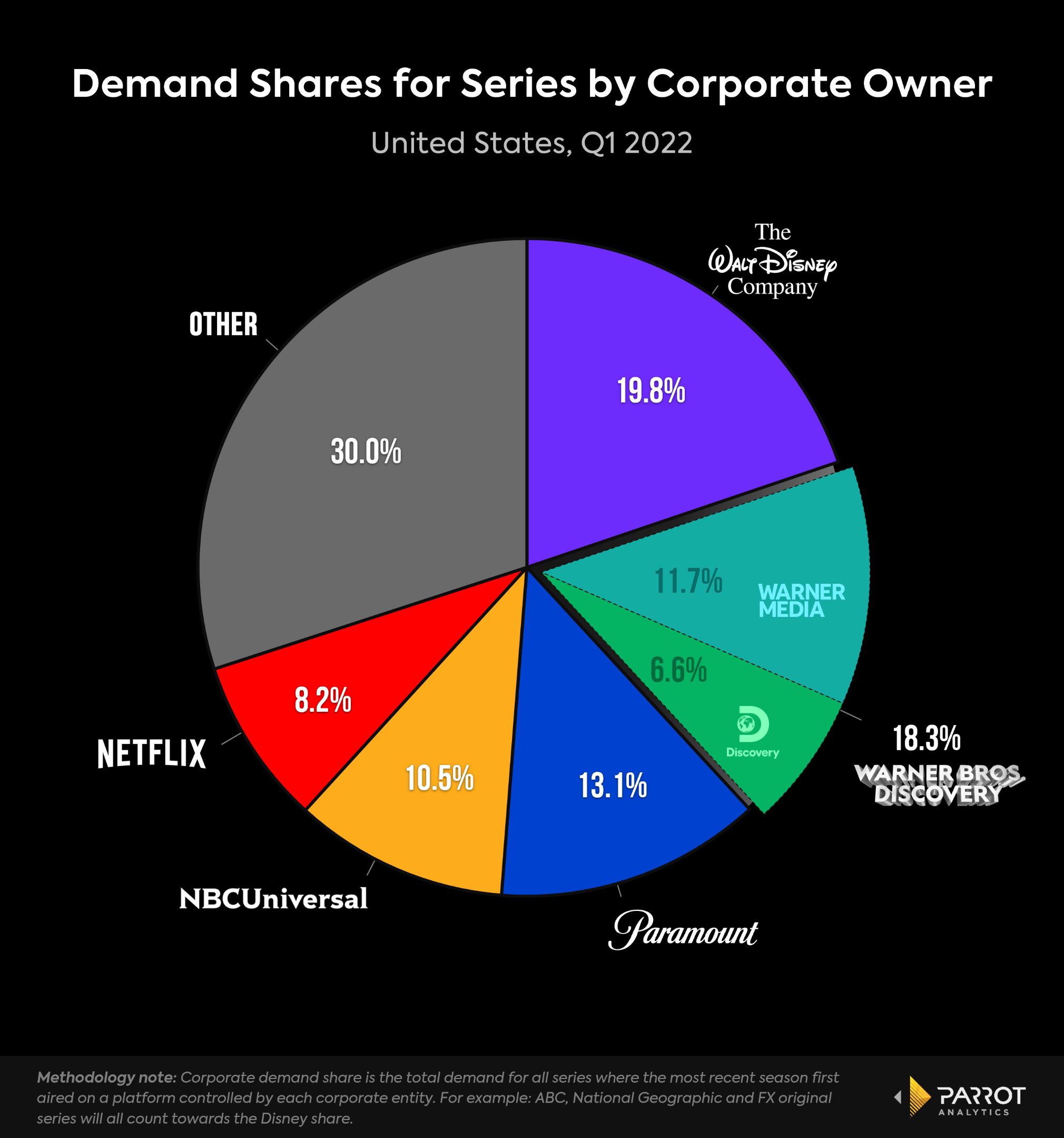

Disney remains in first place in US corporate demand share, although its lead over the competition has shrunk significantly due to the Warner Bros. Discovery merger.

Disney+’s global demand share for streaming originals has increased nearly 50% year over year.

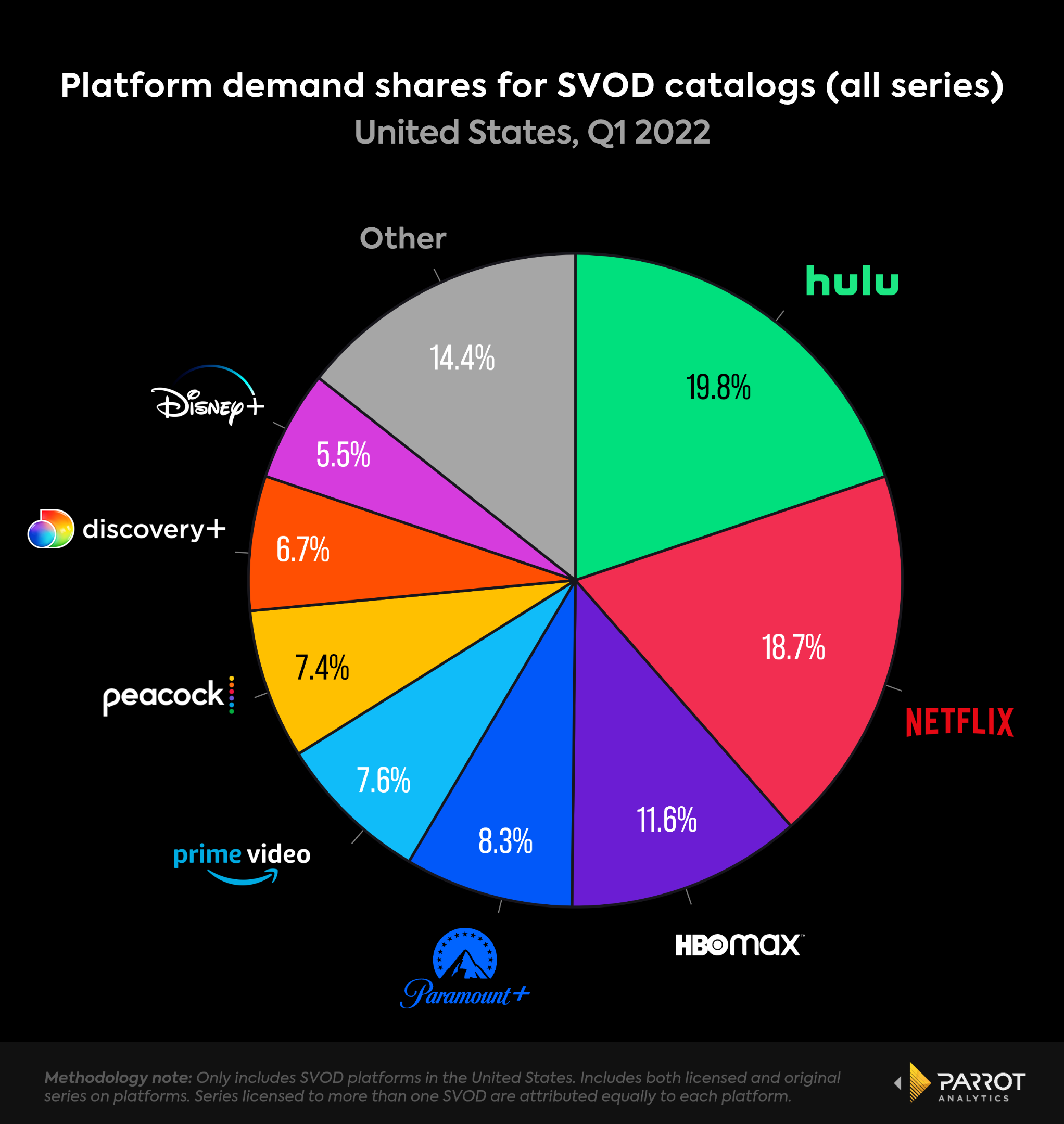

Since the beginning of 2021, all five Marvel live action originals have hit number one worldwide within two weeks of debuting. Five of the top 10 streaming original shows with US audiences last week were Disney+ originals – including two Marvel and three Star Wars series. Hulu leads the US industry in on-platform demand share, a good barometer of which SVODs can serve as the default ‘streaming home’ for tens of millions of consumers.

Just six months ago, Netflix topped Disney as the world’s most valuable entertainment company. As of May 10, 2022, Disney’s market cap was roughly 2.5x times higher than Netflix’s. This ratio is directly reflected in the difference between their respective corporate demand shares – Disney’s 19.8% share was 2.4x higher than Netflix’s 8.2% share in the latest quarter.

While the market could drag down Disney’s stock price in the near term, Parrot Analytics views Disney as one of the three media conglomerates – along with Netflix and Warner Bros. Discovery – with the best long term outlook in capturing and retaining audience attention in the US and around the world.

Corporate Demand Share – United States

Disney remains the top media conglomerate in the United States when it comes to corporate demand share – a consolidation of original demand where platforms are combined based on their corporate parent to show where audience attention is ultimately going.

Disney’s lead over the competition has significantly shrunk. In the previous quarter, Disney led second place Paramount Global (then-ViacomCBS) by 6.4 percentage points (19.7% to 13.3%). With the newly formed Warner Bros. Discovery, Disney’s lead in this key category is down to just 1.5 percentage points (19.8% to 18.3%).

The merger of WarnerMedia and Discovery creates a potent vertically integrated conglomerate that has a better chance of challenging Disney long term than any of the other companies did on their own. This is one of several factors that could lead to further industry consolidation in the near future.

Despite this gap closing, Disney still has the fundamental assets and IP to lead the streaming and entertainment industry well into the future.

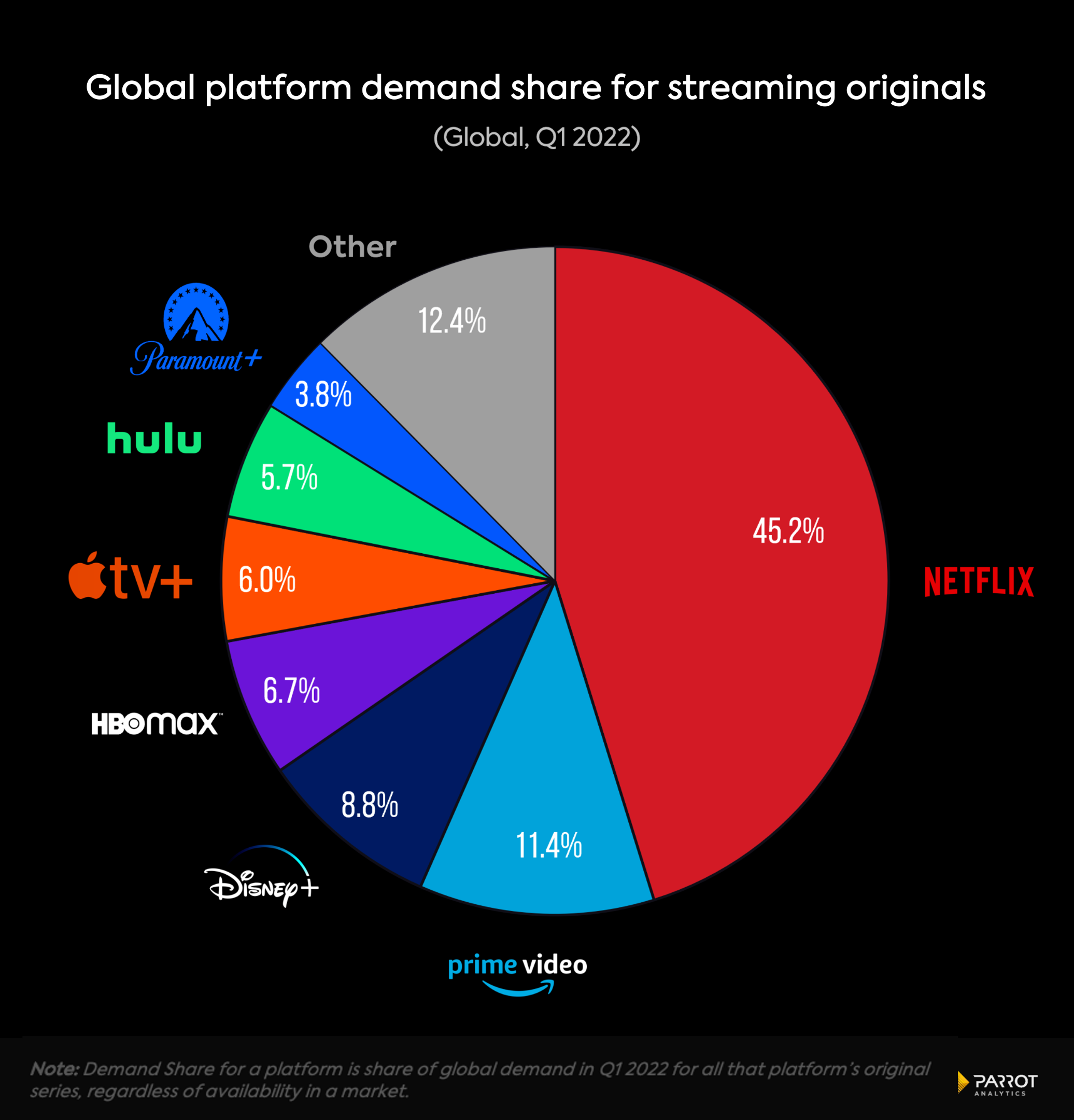

Streaming Originals Demand Share – Global

Disney+ has steadily grown its share of global demand for streaming originals over the last two years – almost exclusively off the backs of its Marvel and Star Wars TV series – and last quarter was no exception. This is important because demand for original content helps drive subscriber growth.

In the latest quarter, Disney+ finished with 8.8% global demand share for streaming originals, up from 8.1% last quarter. This represented a 46.7% demand share increase from the year ago quarter (6.0%), and a 110% increase from two years ago (4.2%).

Hulu’s demand share for streaming originals has been relatively flat over the last year. Hulu and Disney+ have to work well together to get consumers hooked on the Disney bundle.

Disney+ and Hulu combined would make up 14.5% share of streaming originals demand, well ahead of current second place Amazon Prime Video.

On-Platform Demand Share – United States

On-platform demand share data is a good barometer of which streaming services can serve as a default home for consumers – that is, which service someone reflexively turns on when they just want something to watch.

Warner Bros. Discovery’s HBO Max and Discovery+ combine for 18.3% of on-platform demand share, which would finish just behind Netflix (18.7%). However, Hulu and Disney+ combined are at 25.3% – a full seven percentage points ahead of the coming Warner Bros. Discovery bundle.

Hulu faces serious challenges when it comes to maintaining this level of demand share in the near future. Over the coming two years, Hulu will gradually lose its highly in-demand licensed NBC programming such as Saturday Night Live, The Voice and Dick Wolf’s Chicago franchise to NBCUniversal’s Peacock.

Hulu is steadily delivering high quality originals that have generated awards buzz including The Dropout, Dopesick, and Only Murders in the Building. Hulu is also home to FX’s suite of originals including Atlanta and It’s Always Sunny In Philadelphia, which was in the top 0.2% of TV series across all platforms with American audiences last quarter.

FX and Hulu originals remain Disney’s best way to compete for the premium adult content audience against the likes of Warner Bros. Discovery’s HBO and Paramount Global’s Showtime.