A new report by Parrot Analytics indicates the combined Warner Bros Discovery entity would have controlled the second most demand for original content by corporate ownership in the US (17.4%), just behind Disney at 18.9%.

Yesterday, Discovery presented its financial results for the second trimester of 2021, revealing it has already reached 18 million OTT subscribers.

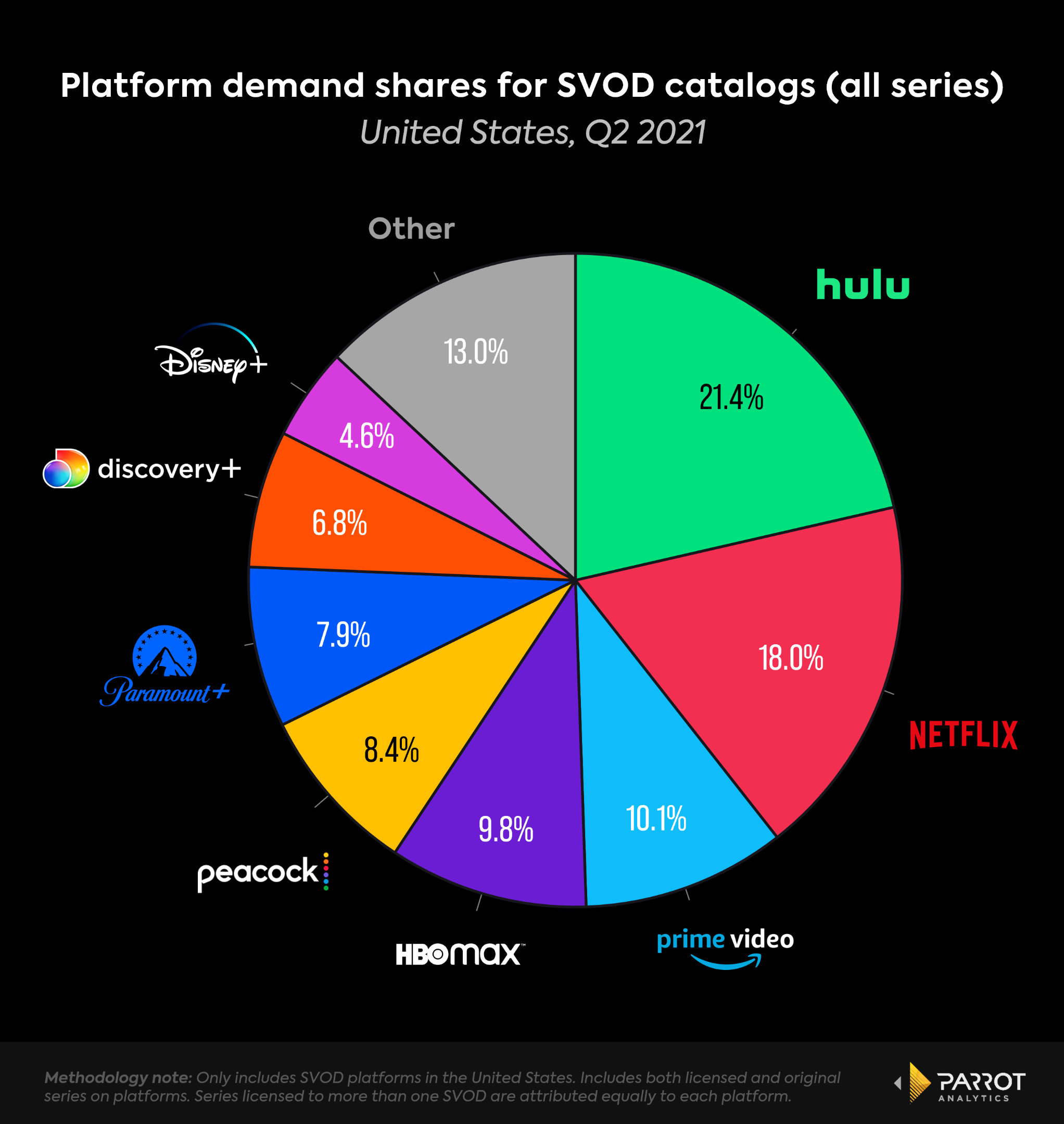

In light of this number, Parrot Analytics has found Discovery+ to be in a very strong position in the US streaming market when it comes to demand for both on platform and exclusive licensed content, a key driver of subscribers to sign up for a service.

Furthermore, the planned Warner Bros Discovery merged company is set to be near the top of the industry when it comes to corporate demand share.

In Q2 2021, Discovery+ (6.7%) outpaced Disney+ (4.5%) in on platform demand share, a measure of demand for all types of content available on a platform.

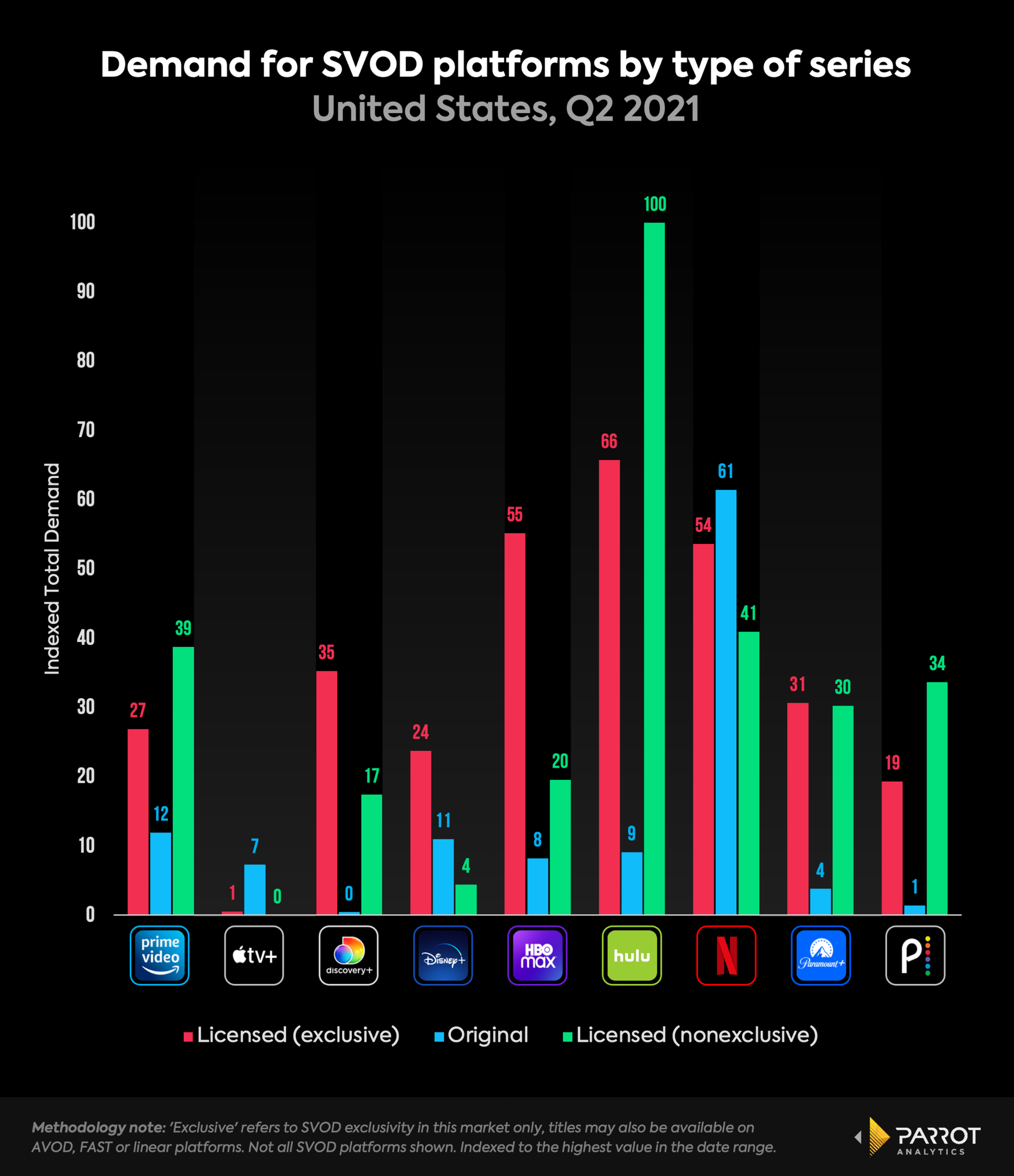

While total demand for all content available on a platform is an important measure, we can break this down further to understand what types of content are driving demand for a platform’s catalog – exclusively licensed, non-exclusively licensed, and platform originals.

In addition, in Q2 2021, Discovery+ was in fourth place in demand for exclusive licensed content, behind only Hulu, HBO Max, and Netflix. This data points to the strength of Discovery Inc’s catalog of cable networks and highly in-demand programming from its networks like the Discovery Channel, HGTV, and TLC. It is also an example of a legacy media company successfully leveraging its assets to transition into the streaming era.

With the impending merger with WarnerMedia, it’s important to consider what the potential Warner Bros Discovery company – which would place Discovery+ and HBO Max under the same umbrella – would bring to the table in terms of demand for original content.

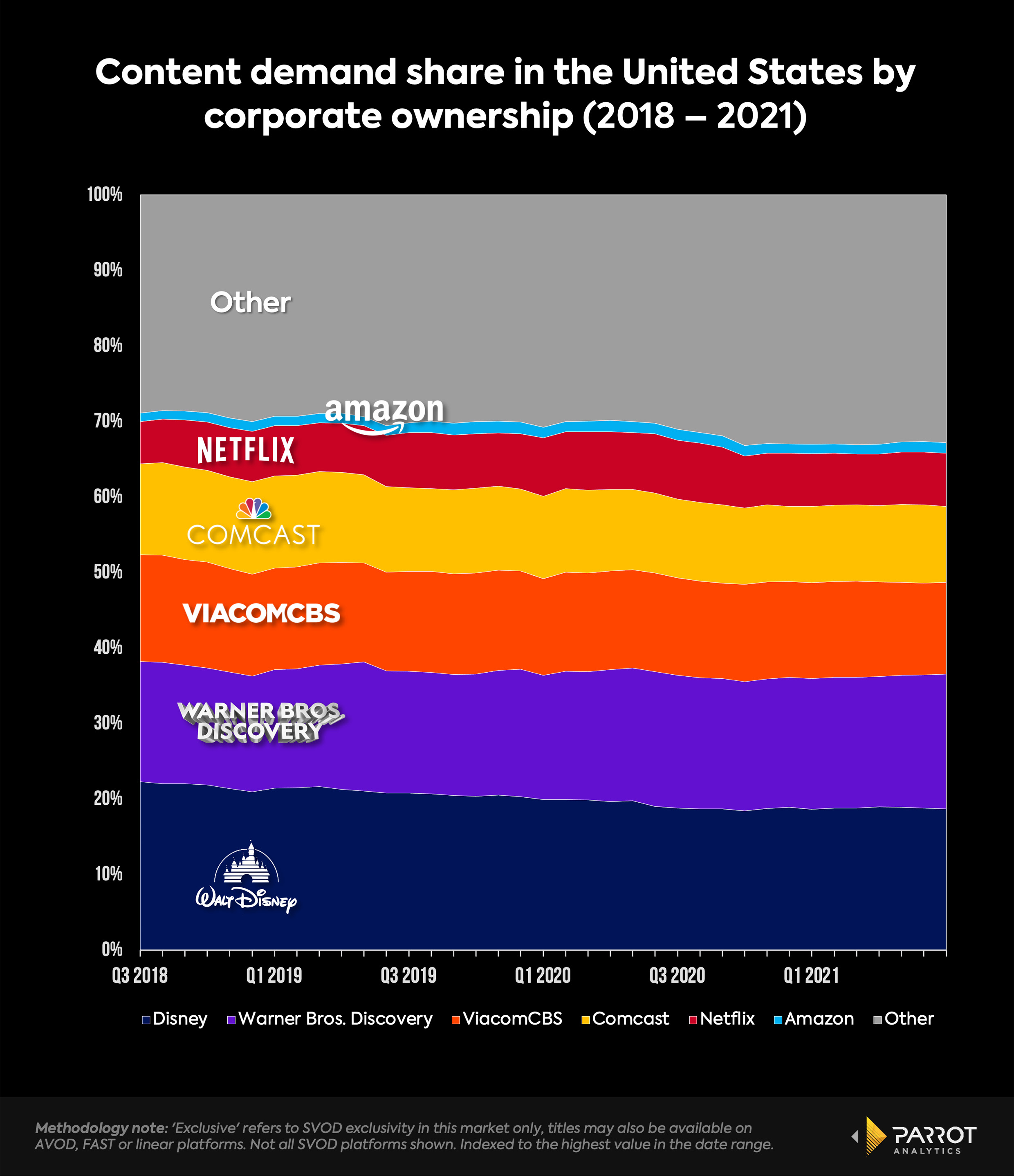

One way to assess this is by combining WarnerMedia and Discovery Inc’s respective corporate demand share – a consolidation of original demand where platforms are combined based on their corporate parent to show where audience attention is ultimately going.

In Q2 2021, WarnerMedia (11.0%) was in third place in corporate demand share, behind Disney (18.9%) and ViacomCBS (12.3%), while Discovery Inc was in sixth place (6.5%) just behind Netflix (6.9%).

The combined Warner Bros Discovery entity would have controlled the second most demand for original content by corporate ownership in the US (17.4%), just behind Disney at 18.9%. This speaks to the value of both companies merging, and suggests they could provide an example of legacy media brands poised to succeed in the streaming era.