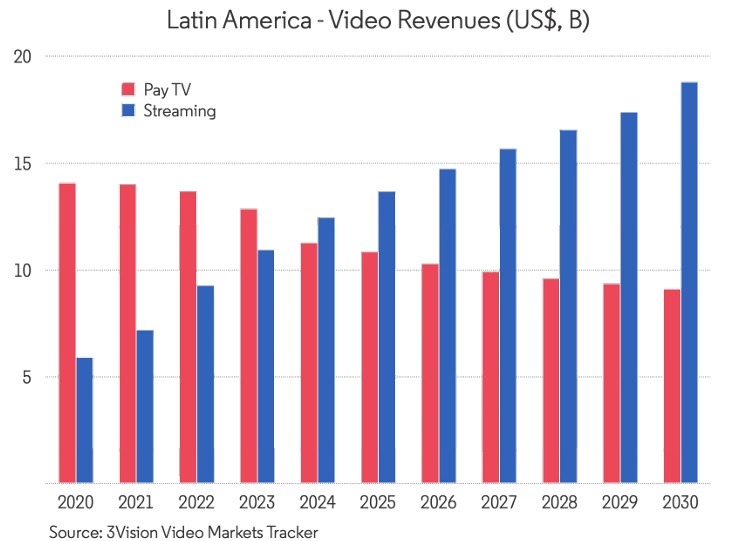

A new report by 3Vision predicts streaming revenues to reach US$ 19bn by 2030 as advertising and multi-subscription households drive the next phase of growth.

Total streaming revenues are projected to increase from approximately US$ 11 billion in 2023 to nearly US$ 19 billion by 2030, overtaking pay TV as the region’s dominant video revenue segment in Latin America, according to new research from 3Vision.

While the number of households paying for at least one SVOD service will grow from around 66 million to approximately 84 million, the more significant shift is within the home.

Total SVOD subscriptions are forecast to rise from 111 million to roughly 176 million by 2030, pushing average subscriptions per paying household above two services. Consumers are layering platforms rather than simply entering the market for the first time.

“Latin America is no longer a story about Streaming penetration, it’s a story about monetization,” said Rafi Cohen, Video Markets Tracker Manager at 3Vision. “The real growth opportunity now lies in how effectively platforms can capture value from households that are already engaged in the ecosystem.”

Advertising is becoming central to that strategy. AVOD revenues are expected to nearly triple to around US$ 6 billion by 2030, contributing almost half of incremental Streaming growth. FAST is emerging as a standout segment, scaling from under US$ 400 million in 2023 to approximately US$ 1.6 billion by the end of the decade.

“As subscription stacking increases, price sensitivity becomes more pronounced,” added Cohen. “Hybrid ad-supported tiers and FAST channels provide the flexibility needed to expand reach without placing unsustainable pressure on consumer budgets.”

In contrast, traditional Pay TV continues its gradual decline. Revenues are projected to fall from around US$ 13 billion in 2023 to roughly US$ 9 billion by 2030, while subscriber numbers edge down only slightly. ARPU pressure and bundled pricing strategies are limiting operators’ ability to generate meaningful incremental growth.

“The next competitive battleground will not be who signs up the most households,” said Cohen. “It will be who can best balance subscriptions, advertising, and distribution partnerships to unlock sustainable long-term growth.”

As Latin America transitions fully into a post-Pay-TV environment, monetization efficiency -not market entry- will define the winners.